Following we system your details, you'll receive a confirmation statement, which you have to signal and post on your employer's payroll Section to allow them to begin earning payroll deductions.

As with 529 cost savings strategies, your money in the prepaid tuition strategy can expand with time. You furthermore may won’t need to pay taxes on certified withdrawals. Nevertheless, you are able to’t use prepaid tuition plans to purchase K-12 education or place and board at school.

The quantity of distributions for loan repayments of any particular person is restricted to $ten,000 lifetime. Desire paid out Using these resources does not qualify for the coed loan curiosity deduction.

Homeowners insurance plan guideHome insurance coverage ratesHome insurance policies quotesBest property insurance coverage companiesHome insurance insurance policies and coverageHome insurance policies calculatorHome insurance policies evaluations

A 529 strategy is actually a tax-advantaged price savings account that’s created that may help you preserve for training expenditures. Also referred to as certified tuition options, 529 designs are supplied by each point out and Washington, D.

Please Take note experienced withdrawals from your PA 529 GSP are made using a “very first in – initial out” foundation, that means your oldest contributions (and any associated progress) are the 1st to get withdrawn.

Account entrepreneurs can change the beneficiary to the account at any time. If, one example is, the kid decides to choose a different route, you are able to alter the account beneficiary to ensure that the money will go toward purchasing a sibling or other loved one's education and learning alternatively.

These credits can’t be useful for room and board and aren’t obtainable for Principal and secondary universities.

Home equity loans Household equity loans Enable you to borrow a lump sum at a hard and fast price, according to the amount of the home you very own outright.

Opt for a beneficiary. If you’re conserving for your son or daughter’s upcoming education, you’ll enter their identify, day of delivery and every other facts the approach necessitates.

HELOC A HELOC is often a variable-price line of credit rating that lets you borrow funds for the established period of time and repay them later on.

The compensation we acquire from advertisers would not impact the recommendations or assistance our editorial workforce delivers inside our articles check here or blog posts or if not impression any of your editorial content on Forbes Advisor. Whilst we work flat out to provide accurate and updated details that we predict you will discover appropriate, Forbes Advisor doesn't and cannot assure that any info delivered is entire and tends to make no representations or warranties in link thereto, nor towards the precision or applicability thereof. Here is a summary of our associates who offer items that We've affiliate hyperlinks for.

It is vital to note that either the account operator or perhaps the beneficiary really should be a Pennsylvania resident at the time the account is opened. A subsequent alter of residency won't have an affect on the Account.

A 529 program, also called a certified tuition program, is usually a tax-advantaged savings plan built to assist you to purchase education and learning. When 529 designs were originally earmarked for faculty and university, they're able to now be used to purchase K-12 education and learning and apprenticeship applications.

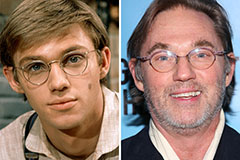

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!